January 2017 Update: Bullish (Unchanged)

Bullish (Unchanged)

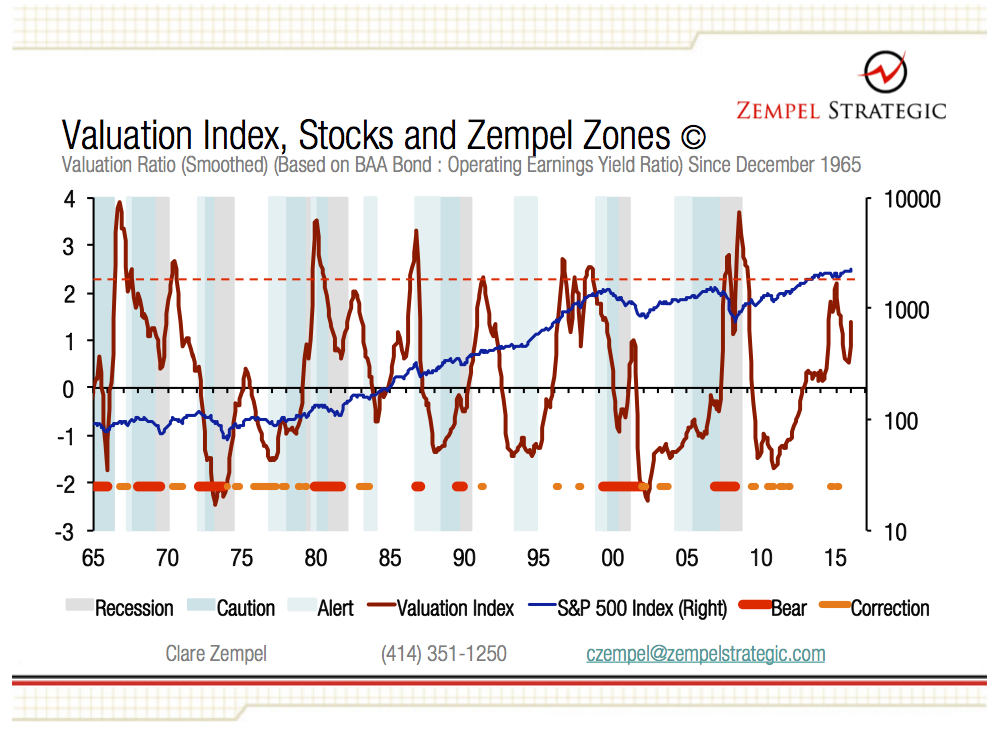

The Zempel Strategic Stock Market Model’s signal remained “bullish” in December 2016. Two model components (valuation and momentum) remained bullish last month, and one (interest-rate changes) remained bearish. According to our rules, the model portfolio remains all invested in common stocks (S&P 500 Index). The Valuation Index approached but never quite reached the “irrationally exuberant” (overvalued) level ( > 2.25 in the chart above) in 2015, and it remains below it. At the same time, the yield spread (not charted above) has remained positive (and even widened sharply recently), so no “Zempel Caution Zone” has been triggered for the economy. Since neither “irrational exuberance” nor a “Zempel Caution Zone” has been or is present, neither a bear market nor a recession seems likely now. The strong implication is that nothing worse than a correction is likely in the months ahead. The model’s view that events like “BREXIT” and elections could cause ripples but not tidal waves seems to have been correct.

-Clare Zempel, December 31, 2016